Surviving & Thriving in Ag's Boom & Bust Cycles

A marketer’s guide to understanding and navigating the volatile agriculture economy

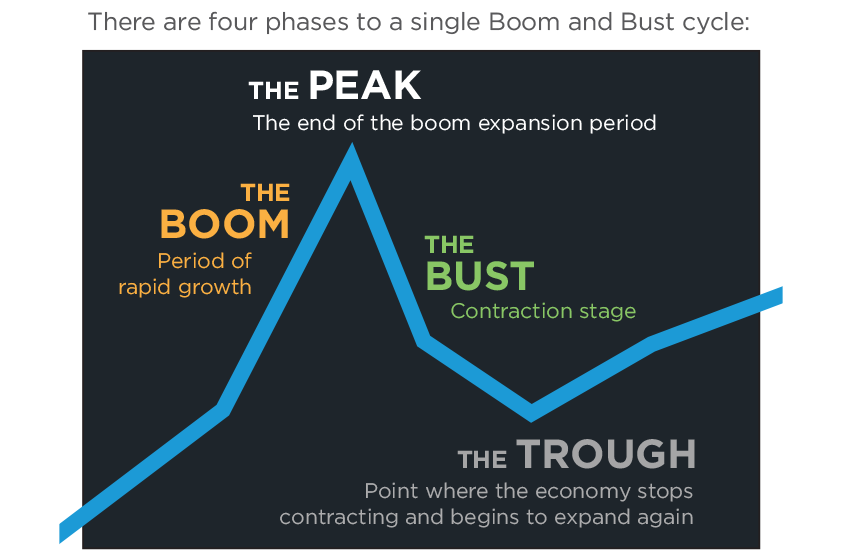

Boom and Bust economic cycles are an unavoidable truth in all economies, and navigating them successfully is often the difference between financial success and ruin. Within our agricultural economy, the pace and extremes of these swings are increasing. Why are we seeing more volatility in our industry, and how should ag marketers respond? To answer that, its important to understand what causes these cycles in the first place.

What Drives the Boom and Bust Cycles of Ag?

Broadly, there are three main drivers of this cycle: the law of supply and demand, availability of financial capital and the future economic outlook. But what dictates the pace and severity of these cycles is the number of major variables that influence them. This is where the U.S. ag industry “outperforms” most other industries – we have A LOT of variables that can drive major swings in both production and demand. Here are a few.

Commodity prices are the ultimate driver of farm income and therefore the foundation of the agricultural industry. Whether corn prices, pork bellies or milk, these commodity prices dictate the economics for farmers in the United States and around the world.

Economic variables including the strength of currencies, global trade access and trends, global crop and livestock production and/or surplus and current interest rates can drastically influence the ag economy. A strong U.S. dollar can actually drive exports down, decreasing demand and commodity prices. A struggling economy in China may decrease the need for imported meat and grain, reducing demand and prices here. A failed soybean crop in Brazil means decreased global supply and increased prices.

Weather and climate such as droughts, floods, frost, hail, and wind can all wreak havoc on crop and even livestock production – not to mention disease and insect pests that come along with certain conditions. Weather can drastically influence supply within the U.S. and on a global scale. Ask any farmer in the Midwest about 1988 and how the lack of rain influenced their income.

Government policy is yet another variable that affects the agricultural economy. From ethanol or bio-diesel blending requirements to farm subsidies and government backed crop-insurance programs, the U.S. government can drastically influence farm income with just a flick of the almighty pen. Just look at the “trade wars” and tariffs effects on commodity prices in 2018. But with another flick of the pen, the federal government made $28 billion available to help off-set these trade-related losses.

So What Is an Ag Marketer To Do?

It can be tempting to aggressively cut marketing budgets during downturns in the ag economy, especially because it doesn’t always have an immediate effect on sales or gross income but does immediately reduce costs. But those cuts often have lingering effects on market share and brand health for months and even years to come. Here’s our advice:

- Take a long-term view to your strategic planning but pay attention to the short-term realities as well. We all know that building a brand takes time and what you spend in marketing today will continue to drive awareness and sales over the next 12 to 18 months.

- Revisit your business objectives and communications strategies first. Do any of them need to be adjusted or even thrown out, even temporarily? Once you have confirmed those foundations to your planning, begin evaluating your tactics and channels with them in mind. Which aspects of your activation plan are most crucial, and which are nice-to-haves?

- Watch the ag economy indicators closely to avoid going dark at the wrong time. Identifying the beginning of a growth trend can allow you to be out in front of your competition during key moments in time, keeping in mind that much of our marketing efforts take time to deliver results. Spotting that next growth trend 6 months out or so can be hugely beneficial to your business and brands.

Where are we now?

The ag economy boom from 2010 until 2014 feels deep in the past, as it has struggled in recent years with a surplus of global storage, reduced demand and significant trade and policy issues. But there are glimmers of good news on the horizon as we see demand starting to recover, global markets opening back up and surpluses being consumed.

The combination of increasing futures commodity prices and 2020 farm income being up 43% over 2019 (due largely to continued government payments) has led to a drastic improvement for the ag economy. In fact, grower sentiment has jumped significantly in the last year, according to the Ag Economy Barometer from Purdue University. In March of 2019, it was below 100 and has since climbed back to 167 as of February 2, 2021.

Many indicators are pointing to an economic recovery for the ag industry over the next few years. And while there is no such thing as a sure thing – we have discussed the many variables that can shift quickly – the major trend drivers are all in place. USDA projections show 2021 farm income climbing to the highest point since 2013.

An extended period of decreased income and confidence followed by strengthening income and confidence is likely to drive significant capital investments in operations by Q3 and Q4 of 2021 that have been put off for the last several years. Now is the time to finalize strategies and get in market ahead of the boom, especially for equipment and infrastructure brands (grain storage, farm/livestock buildings).

If you need a sounding board to discuss your ag marketing strategy, contact Gino Tomaro, R+K Business Development Director, at gtomaro@rkconnect.com to start a discussion.

Never miss an article.

Get the latest sent straight to your inbox.

Related Articles

Three tips to keep your entitled farmer-customer happy

At a conference, ...